(Please note that this post is a work in progress with additional material added when appropriate.)

Update 3rd September – more added including Trustpilot reviews and various Tweets inc from the excellent ECF Buzz @makeyoubillions )

Update 6th September – the very useful wine-searcher has removed Winebuyers' list from their website:

wine-searcher is the world's largest search engine for finding wines and where you can buy them, so having your list removed is significant.

18th November 2021: Change to sum owed to Museum Wines. See section on Ben Revell's Statement of Affairs.

•••

How to run up over £2.2m losses, go bust and start again with a clean slate...

On 1st April 2021 (April Fools Day) the recently created (8th March 2021) Wine Buyers Group Ltd acquired the website of Winebuyers Ltd for £145,000, which was agreed at a meeting of creditors two days before had passed a resolution that the company should be wound up. A Statement of Affairs, signed by Ben Revell, director, shows that Winebuyers Ltd has a deficiency of £1,548712.07. How fortunate that Winebuyers Group Ltd with a new director – Kyle Fordham (who?) – has been able to rise gracefully unencumbered by the £1.548 million debt owed to trade creditors....!

Winebuyers Ltd

The company started life as LX Management Ltd on 8th October 2015 with Benjamin Allan Edward Revell (DOB: 2.12.1988) as the sole director with a service address at a semi-detached house in Harlow, Essex. Share capital was a single £1 share held by Ben Revell – occupation retail manager.

The company name was changed to Winebuyers Ltd on 18.9.2017. By April 2018 Winebuyers Ltd had successfully raised £568,870 through Crowdcube Capital Ltd:

Crowdfunding through Crowdcube:

Winebuyers Pitch through Crowdcube:'

'Winebuyers connects vineyards and wine merchants directly to the end consumer, cutting out the middleman and enabling customers to purchase directly from source for no extra fee. Custom API's automate the process, currently pulling 27,000 bottles and £10.5m stock from 183 vendors in 38 countries.'

'Idea

Our aim at Winebuyers is simple: bring wine into the 21st century.

We connect vineyards and wine merchants directly to the end consumer through our e-commerce platform.

We are customer focused, working on a completely transparent model, we don’t mark up prices or charge commission on any item sold. We cut out the middleman, enabling our members to buy wines at exactly the same price as they would from the vendors themselves.

We obtain our revenue from charging vineyards and wine merchants a monthly subscription fee to be listed on the site. This model is new to the industry, giving smaller vineyards and sellers the opportunity to reach audiences they otherwise could not.

Members in turn can purchase directly from the source with no additional fees. Without the overheads associated with holding stock, we can afford to work on a PCM subscription basis providing a mutually beneficial relationship to all involved.

We currently offer over 27,000 different wines from 183 vendors representing 38 countries who together have a total stock value of over £10.5m. Loans exist.

Over £180k was committed to R&D work alone in 2016 and 2017, which has laid the foundations for the business model. There are currently 150,000 different winemakers globally, providing ideal scope for expansion.

We want wine from all over the world to be accessible to everyone who’s as passionate about wine as we are.'

- Winebuyers.com lists 27,000 bottles and £10.5m stock from 183 vendors

- 150,000 winemakers globally, industry to be worth over $400bn by 2022

- Scalable model - Experienced team - 2,700 suppliers already registered

- Custom API's automate the entire process minimising costs on all sides'

One would expect Winebuyers Ltd' pitch for funding to be very positive. Unfortunately Winebuyers Ltd's accounts told a rather different story. The company only made a profit in its first year of operation (accounts to 31.10.16) – £3159 in its profit and loss account filed 27.6.17. Thereafter it was a case of escalating losses:

Accounts to 31.10.17 – (£62,827) in its profit and loss account filed 27.11.17.

Accounts to 31.10.18 – (£515,262) in its profit and loss account filed 25.7.19

Accounts to 31.10.19 – (1,297,450) in its profit and loss account filed 30.10.20

Three new directors:

On 7th January 2019 three new directors were appointed: Frederic Billet (French, DOB: 9.1970 – hotelier), Mehrdad Amir-Mokri (Austrian, DOB: 4.1967 – investment professional) and Santiago Barbat (Portuguese, DOB: 10.1981 – Head of Development). Amir-Mokri resigned as director on 10th October 2019 and Barbat resigned on 10th December 2019).

By 2019 there were the first rumours of suppliers not being paid. This accelerated in 2020 into early 2021. Also numerous Trustpilot reviews showed that customers were not get the wines they had ordered. On 25th February 2021 The Drinks Business reported that Winebuyers Ltd had six County Court judgments against it totaling £42,384. Winebuyers Ltd continued to list wines that they knew they couldn't supply as merchants/suppliers had ceased to work with them. See blog post from Master of Malt below.

Despite Winebuyers Ltd parlous state they continued to promote their wines on Twitter during 2021 probably aware that they were unlikely to be able to fulfill orders:

30th April 2021: Creditors' Resolution to wind up Winebuyers Ltd and liquidator appointed.

Liquidators: Andrew Pear and Michael Solomons, BM Advisory Tel: 020-7549 8050.

Insolvency practitioners are required to report on matters of concern. I imagine Andrew Pear and Michael Solomons will want to establish whether Winebuyers Ltd continued to trade while insolvent.

31st April 2021: Creditors/ liquidation committee established.

Members in addition to the two liquidators:

Delantalo Vinos SL, Atom Supplies Ltd (Master of Malt), Awin Barrett Siegel Wine Agencies LLP, Enotria Wine Cellars Ltd and Great Wines Ltd.

Ben Revell's Statement of Affairs 23rd March 2021

The estimated total assets for preferential creditors is £148,500. Sums owing to preferential creditors are for employees and former employees (£25,798.81) and HMRC £30410.06 leaving £92,291.13 for unsecured creditors. The estimated deficiency for unsecurred creditors is £1,641,001.93 less £92,291, so an estimated deficiency of £1,548,710.80. In practice a considerable part of the £92,291.13 will be swallowed up by the costs of the liquidation, so unsecured creditors will get back a minimal amount at best.

Trade creditors

The list of company creditors runs to eight pages with a further 11 pages giving details of shareholders. Prominent among the trade creditors are:

Knotel UK Ltd: £244,282

('tailoring workspaces to the unique needs of established and growing

companies. From space to services, we give companies the freedom and

flexibility to grow and adapt to today’s ever-evolving workplace

demands.')

H & H Fine Wines: £120,018

Enotria & Coe: £96,643.82

Blueshift Labs Inc (San Francisco): £33,118.

'Discover how you can intelligently collect, unify, and access a

360-degree view of each customer and start delivering truly connected

omnichannel experiences.'

Barclays (Hammersmith): £77,930

decantalo (Barcelona): £70,592

Great Wines Direct: £64,863

WeWork: New York £46,708

'flexible work spaces'

Atom Group (owns of Master of Malt): £35,725

Affiliate Gateway (Haywards Heath): £33,224

'We’re specialists in performance marketing with a wealth of experience in retail, travel, insurance and finance.'

'Go beyond the expected'... unfortunately came true for this marketing company to the tune of £33,224!

Stature PR Co (London): £25,116

Museum Wines: £15,813 *

Update – 18/11/21

Museum Wines submitted a claim for £25,338.34 rather more than WineBuyers Mark 1 admitted (£15,813). – a court found in Musuem Wines favour and they have a judgment against WineBuyers Mark1 for this sum. This figure includes the monthly subscription fee dating back to the last time WineBuyers paid Museum Wines on time (May 2020) since WineBuyers were in breach of contract and thus Museum Wines wre not obliged to pay this fee. Also included was a promotion that WineBuyers ran offering free shipping without Museum Wines' authoristion, so the P&p costs for the 50 cases sold.

Honest Grapes: £15,298

Petersham Cellar: £15,200

Latin-wines-online: £15,112.77

Other creditors?

There are only trade creditors listed in Ben Revell's of Affairs Statement, so mention of customers who ordered wine and have received nothing part from broken promises as a number of reviews on Trustpilot show. Those who crowdfunded Winebuyers to at least £568,870 will also be out of pocket – the Statement of Affairs. Thus the losses racked up by Revell's Winebuyers Ltd – trade creditors plus shareholders is in the region of £2,210 million with an unknown number of customers would didn't get the goods they ordered.

These shareholders may well be more than interested that the Financial Ombudsman in May 2021 upheld a complaint from someone who invested in a company through Crowdcube Capital Ltd. Part of the Ombudsman's decision is given below.

'As explained in my provisional decision - given the generally higher risk nature of these investments, and the likelihood that these companies might fail, I consider there was an equal chance he may have lost some or all of his investment had he invested in another crowdfunding opportunity other than in Company A. I acknowledge that he might also have made a return. But without the benefit of hindsight, it simply isn’t possible for me to fairly establish what return he would likely have made, if any. For these reasons, I consider that fair and reasonable compensation be a return of Mr S’s initial investment, subject to the deduction of any tax relief that he claimed at that time.

my final

decision

For the reasons given above, I uphold this

complaint and direct Crowdcube Capital Limited to put things right as set out

above. Under the rules of the Financial Ombudsman Service, I’m required to ask

Mr S to accept or reject my decision before 12 April 2021.'

Ben Waites

Ombudsman

https://www.financial-ombudsman.org.uk/files/301390/DRN7590473.pdf

Press coverage:

Positive:

Unfortunately Ben Revell managed to get some uncritical press coverage. Here are some examples:

Sky News Ian King live https://www.youtube.com/watch?v=LlbSJvn9GUM

Financial Times: September 9th 2020

If Revell is 'still in the business' in 10 years times, how many times will an incarnation of Winebuyers risen from the ashes?

Negative press:

An early warning came from an excoriating blog post (10.2.2021) by Master of Malt, a supplier to Winebuyers Ltd, who started having payment issues with Ben Revell as early as 2019. Master of Malt took legal action to try to get payment.

'Online order aggregator Winebuyers stopped paying suppliers in full in 2019, and has since racked up substantial debts as it failed to pay its suppliers for goods and services provided in good faith.

The drinks business is an amazing industry to work in, filled with brilliant people and exciting, innovative businesses. It’s an incredibly small, tight-knit community where everyone knows everyone, and as a result, the standard of conduct and honesty is very high.

Very occasionally someone comes into the industry who doesn’t appreciate and respect these bonds of trust, and when that happens we feel a responsibility to let others know how badly they’ve behaved so they don’t get burned as we have been.

We, therefore, feel an obligation to warn others in the industry about Ben Revell, Founder and CEO of Winebuyers.com.'

**

'We find Mr. Revell’s conduct to be utterly shameful, reprehensible and quite possibly criminal, and believe his future victims have a right to know how he conducts himself before entering into a business relationship with him.'

Fortunately there were other less gushing, more critical journalists mainly in the drinks trade press:

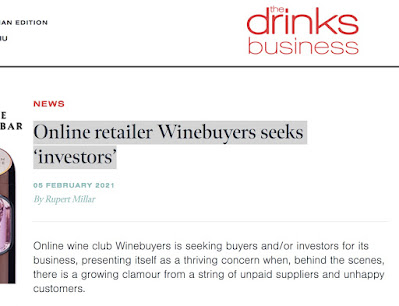

The Drinks Business 5th February 2021

Casts a critical eye over crowdfunding investments and has been very incisive over Winebuyers Ltd (Mark 1) and Winebuyers Group Ltd (Winebuyers Mark 2). Well worth following. Here are a small selection of tweets:

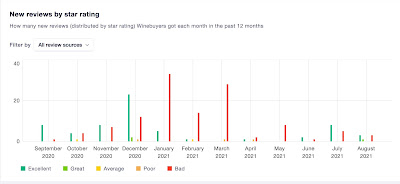

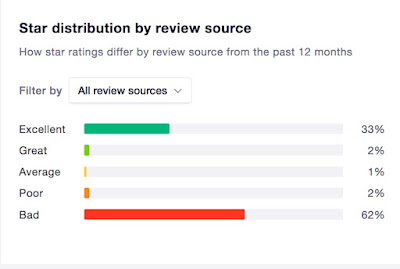

Trustpilot Reviews

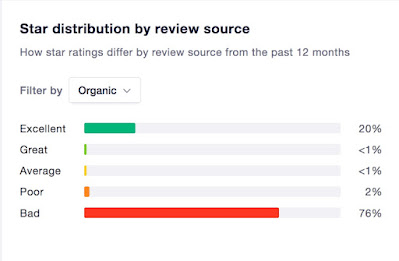

Reviews of Winebuyers Ltd are very polarised: either they are 'excellent' or 'bad' as this analysis of the reviews shows.

62% 'bad' reviews in the last 12 months

Positive reviews come from people invited (Manual invitations) to post a review. Whereas the negative ones come from people who post on Trustpilot off their own bat (Organic reviews) with fewer positive reviews.

76% Bad reviews over last 12 months

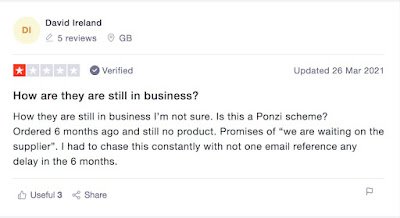

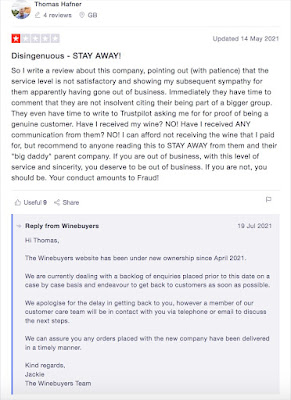

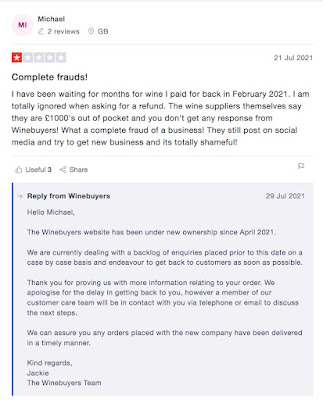

Examples of bad reviews:

Winebuyers Group – same fate?

This recently minted company was set up on 8th March 2021 just 22 days before Winebuyers Ltd (Mark 1) went into liquidation. The sole director is Kyle Fordham (DOB: 6.1989) who holds the single £1 share and has 'significant control' of the company. The registered office is Kemp House, 160 City Road London, EC1V 2NX – a virtual office company.

Nigel Huddleston reports in his fine article – Winebuyers reboot raises questions – that it was agreed that Ben Revell would not be involved in the new Winebuyer Group Ltd (Winebuyers Mark 2). Instead Huddleston reports that at least until July Revell has been signing himself as the CEO of Winebuyers Group. So it may be that Revell is the shadow director and Kyle Fordham as the patsy...?

Who is Kyle Fordham?

Does anyone know a Kyle Fordham?

'a turbulent few months in 2020'...

Revell's continued involvement in Winebuyers Group Ltd is confirmed by an email exchange between Winebuyers Group through a young, persistent and I fancy increasingly desperate 'sales executive, who uses a USA phone number (eastern Pennsylvania) having joined Winebuyers Group in June 2021 and wine merchant Stone, Vine & Son. The exchange also illustrates why it will be very difficult for Winebuyers Mark 2 to get anyone to supply them likely to be made even harder with Revell apparently still running the company. Winebuyers Mark 2 may have acquired a large potential customer base from Winebuyers Mark 1 but will they be able to offer much in the way of wines and spirits?

Nor is there any reason to believe that Revell's model of charging suppliers for exposure and customers who order through the Winebuyers' platform actually works. Among Winebuyers creditors there are PR and marketing companies along with office space providers who are all owed substantial sums. Looks like Revell's model doesn't generate sufficient revenue to cover the company's costs.

Sent: 25 August 2021 16:37

To: Sales

Subject: Winebuyers keen to list your products.

To: Sales

Subject: Re: Winebuyers keen to list your products.

***** appears to be desperate as she is still chasing Stone, Vine & Son (2.9.21):

They never give up! Arrived 5 minutes ago…

From: *****

Sent: 02 September 2021 16:06

To: Sales

Subject: Re: Winebuyers keen to list your products.

Hello,

I just wanted to give it another shot in seeing if a partnership with Winebuyers could be of interest to you?

Please let me know!

Best wishes,

*****

US based sales executive continues to be busy...

Prestigious Wine Ltd

This is Ben Revell's other company, which according to the FT article, was the best preparation for Revell through 'buying and selling investment wines online'.

Although Revell claims that he had 'a very crude UK website' a Google search doesn't list a website for Prestigious Wine Ltd (created 1.8.2013). Also the filed accounts indicate that the company never did very much business despite Revell's £300,000 worth of stock. From the accounts to 31.7.17 the busiest year appears to have been 2016-2017 with total net assets listed as £8329. Ben Revell (DOB: 2.12.1988) and Bonnie Revell (12.12.1958) are the two directors with a Peter Revell as company secretary. Interestingly a Peter Revell of Flat 1, Shelton Street, Covent Garden, London WC2H 9JN is listed as a creditor of Winebuyers Ltd owed £110,359. On 23th July 2021 Bonnie and Ben Revell applied to have the Prestigious Wine Ltd struck off.

£

£