Château Lafite, Pauillac

There are claims that wine consistently out-performs other investment assets classes and that £10,000 invested would provide an annual profit of over £2000 over a ten year period.

'Over 10 years an investment of £10,000 would

earn you on average over £2,000 every year'

Initial capital of £10,000

chart giving average 10yr rtn

showing £16,247.10 after 4 years

showing £16,247.10 after 4 years

It appears that Cult Wines Ltd base their projections on The Liv-ex Fine Wine Investables Index

'From the Liv-ex site: 'About the Index

The Liv-ex Fine Wine Investables Index is designed to track the wines commonly found in a wine investment portfolio. The index consists of Bordeaux red wines from 24 leading chateaux. The component wines date back to the 1982 vintage and are chosen on the basis of their score from Robert Parker. The wines are priced using the Liv-ex Mid Price with various scarcity weightings applied to account for older vintages and wines produced in smaller quantities.

The index dates back to January 1988 and was rebased at 100 in January 2004. Liv-ex has been calculating Mid Prices for selected wines from 2001 onwards. Component prices prior to that date are the result of an extensive collection of historical price data from leading fine wine merchants.'

The Liv-ex Fine Wine Investables Index is designed to track the wines commonly found in a wine investment portfolio. The index consists of Bordeaux red wines from 24 leading chateaux. The component wines date back to the 1982 vintage and are chosen on the basis of their score from Robert Parker. The wines are priced using the Liv-ex Mid Price with various scarcity weightings applied to account for older vintages and wines produced in smaller quantities.

The index dates back to January 1988 and was rebased at 100 in January 2004. Liv-ex has been calculating Mid Prices for selected wines from 2001 onwards. Component prices prior to that date are the result of an extensive collection of historical price data from leading fine wine merchants.'

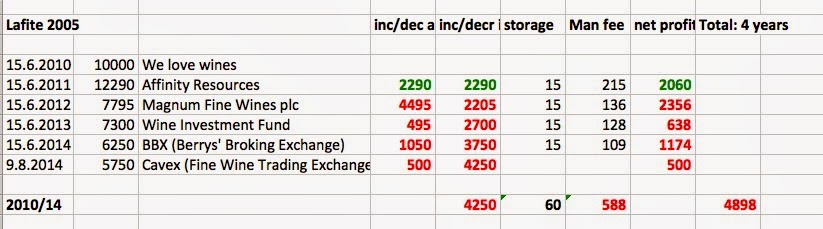

I thought it would be interesting to put these claims to a small test. Using wine-searcher I looked at the prices of a case (x12) of 2005 Lafite over the past four years, which could have been bought in June 2010 for £10,000 – the cheapest UK price (We love wines) shown.

2005 Lafite: profit and loss account

Col 3: merchant on wine searcher offering lowest price

Col 4: annual increase or decrease on price

Col 5: net profit or loss on year

Col 6: loss over 4 years

The investor's Lafite that cost £10,000 in June 2010 could be bought on 9th August 2014 for £5750 from Cavex – down by £4250. This loss is compounded by £60 for annual storage and insurance charges (figure taken from Cult Wines Ltd' charges as stated by Premier Cru in their 31.7.14 letter to their clients). Loss climbs to £4310. If the case had been with a wine investment management company and assuming an annual management charge of 1.75% (as charged by Premier Cru Fine Wine Investments Ltd) on the value of the portfolio, then a further £588 must be factored in. This brings the total loss over the four years and two months to £4898 or £1224.5 a year some distance away from an annual profit of 'over £2000 a year'. Even the worst performing Cash ISA would have performed better.

Obviously there are some caveats here. The Lafite's performance is charted over 4 years and not ten. 2011 to 2014 has seen the worst wine bear market for many years. I have looked at just one wine and not a balanced portfolio albeit that Lafite, especially a vintage like 2005, is a popular choice for wine investment.

••

Cult Wines Ltd: projection £10,000 could

on average become £23,380.70 in 7 years

2005 Lafite European auction prices: Jan 2007 - July 2014

Col 2: auction prices 2007-2014

Col 3: prices including Buyers Premium and sellers commission

+ net

Col 4: storage at £15 a case per year

Col 5: management fee of 1.5%

assumes that wine is held through investment

company that charges a fee

Taking a longer view (7 years) using auction figures on 2005 Lafite (January 2007- July 2014) from wine-searcher makes this for the moment a better investment, although still far from an average profit of over £2000 a year.

The wine-searcher figures show that the 2005 Lafite bought at auction in January 2007 for £3700 (£4329 with buyers premium of 17%) could have been sold at auction in July 2014 at £8784 (£7905 with seller's commission deducted – calculated at 11%). This gives a gross profit of £3576. Take away the cost of seven years storage (£15 a case as charged by Cult Wines Ltd = £105) – profit is reduced to £3471 (£496 a year). This is still a very decent profit over the seven years but nowhere close to £2000 a year.

Had the investors entrusted their case of 2005 Lafite with a company charging an annual management fee at 1.75% (like Premier Cru Fine Wine Investments or Cult Wines Ltd) the net profit would be reduced by a further £1327.69 to £2143 (£306 a year). Still far better than a Cash ISA but the investor will be offering prayers that the wine bear market ends soon, otherwise their profit will be further eroded.

The wine-searcher figures show that the 2005 Lafite bought at auction in January 2007 for £3700 (£4329 with buyers premium of 17%) could have been sold at auction in July 2014 at £8784 (£7905 with seller's commission deducted – calculated at 11%). This gives a gross profit of £3576. Take away the cost of seven years storage (£15 a case as charged by Cult Wines Ltd = £105) – profit is reduced to £3471 (£496 a year). This is still a very decent profit over the seven years but nowhere close to £2000 a year.

Had the investors entrusted their case of 2005 Lafite with a company charging an annual management fee at 1.75% (like Premier Cru Fine Wine Investments or Cult Wines Ltd) the net profit would be reduced by a further £1327.69 to £2143 (£306 a year). Still far better than a Cash ISA but the investor will be offering prayers that the wine bear market ends soon, otherwise their profit will be further eroded.

Hi Jim,

ReplyDeleteI'm confused. If the Cult Wines figures are calculated on a Liv-ex wider market indices, why are you comparing that with one crude example of the worst performing wines over the past few years?

Just because my Morrisons shares are down 26% this year or my American Apparel shares are down over 60%, does it mean my stockbroker isn't allowed to boast about my Astra Zeneca share performance?

Please explain

Chris

Chris. An interesting question which deserves a full reply, which I will post tomorrow. Basically this is a snapshot but a realistic example of wine investment.

DeleteChris.

DeleteThe Liv-ex index used here covers 24 leading châteaux – I suspect few investors will have such a wide range of wines in their portfolio. Small investors will have and be relying on just a few wines. A number are likely to have 2005 Lafite, which illustrates the potential volatility of fine wine.

I could have selected an actual example from Cult Wines Ltd's business. In mid-2010 a putative and first time investor met Cult's director, Tom Gearing, at an investment exhibition at the Business Design Centre in London's Islington. Soon after this he was persuaded by Gearing to buy a case (12b) of 2009 Carruades de Lafite. He paid £2600 + 15% commission charge making a total of £2990. A few months Gearing persuaded him to buy a case of 2009 Les Forts de Latour for £1800 plus a 10% commission charge – Gearing trimmed it down from the usual 15%. Total expenditure £4970.

Four years on the investor is looking at a substantial loss – using wine-searcher the price for the Carruades has dropped by to earth at £1480, while the Les Forts can be purchased for £1320. The Les Forts has shown less volatility in a long bear market. Total cost to purchase £2800. The investor is looking at a loss of £2170 or £2230 if storage charges are included.

Given that Cult Wines Ltd charge a 15% commission charge it would be reasonable for investors to think they are given sensible advice. Tom Gearing ought to have known that Les Carruades de Lafite was a high risk, bubble stock that was not suitable as a first purchase for a first time investor.

Entirely reasonable I think to look at how individual wines have performed.