'subsidary' (sic) arm of PENKETH DEVELOPMENTS LTD

Our services: Penketh Associates – investment planning,

retirement planning, planning your estate, personal cash

Update: 30th August 2016 – the above website, which was registered on 28th July 2016, has now disappeared.

••

Crates and pallets & site construction in Islington

••

••

Birmingham: 'so Penketh Developments Limited

is engaged in Buying and selling of own real estate'

is engaged in Buying and selling of own real estate'

Here we have yet another company – Penketh Associates, a subsidary (sic) of Penketh Developments Ltd – that is claiming falsely to have taken over as liquidator of Bordeaux Fine Wines Ltd from David Ingram of Grant Thornton as well as recovering missing wine for investors.

Message from Grant Thornton – re Bordeaux Fine Wines Ltd

'In addition, we have been contacted by a number of investors recently who have been contacted by a company called Penketh Associates (penkethassociates.co.uk). They have been advising creditors (in Bordeaux Fine Wines Ltd) they have replaced David Ingram (Grant Thornton) as Liquidator and that they have "found their wine". One investor has transferred £10,000 and surprisingly hasn't received anything in return.

I have advised the police of this company and they are currently assisting the creditor to get their money back."

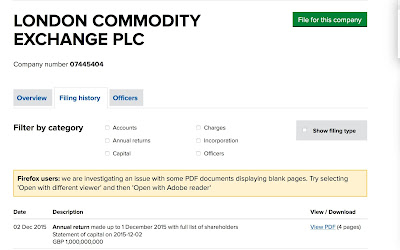

Company history and activities

It has to be said that Penketh Developments Ltd is somewhat of a mystery. Penketh Developments Ltd was founded on 9th December 2002 with a share capital of £2 held by the company formation agents. It remained a dormant company until 31st December 2013. The accounts to 31st December 2013 listed assets as £2 – the original share capital. However, the accounts to 31st December 2014 listed stocks for 2013 as £100,000.... presumably the £100K shares belonging to Robert Hawes as listed on the annual return to 9.12.14 filed on 21.7.2015.

Balance sheet 31.12.13: current assets £2

Balance sheet 31.12.14 – stocks (2013) £100,000

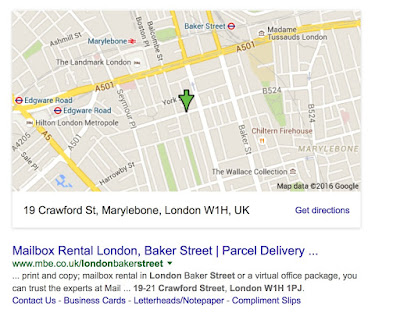

On 1st November 2014 Robert Hawes (DOB: May 1967) was appointed a director of Penketh Developments Ltd. However, this appointment wasn't filed at Companies House until 21st July 2015. On 21st April 2015 a First Gazette for a compulsory strike off was issued. This was lifted on 22nd July 2015 once the annual return to 9.12.14 was filed on 21.7.15. On 11.6.2015 the registered office was changed to Unit 9, 3 Warstone Lane, Hockley, Birmingham B18 6JE, where the company's activity was apparently 'Buying and selling of own real estate'.

Balance sheet to 31.12.2014

Current stocks in the first year of trading starting presumably on 1st November 2014 when Robert Hawes was appointed a director taking over from the company formation agents were listed as £1,907,540 with total assets less current liabilities as £2,040,722. Total net assets including liabilities were £1,161,234. It looks like Robert Hawes, described as sales director, should be congratulated on a remarkable achievement on only just two months (November and December) of trading. The accounts are unaudited as under UK company there is no requirement for small companies to have their accounts audited.

Change of directors

Despite Hawes admirable success during the company's first two months of trading, he resigned as a director on 5th January 2015, although his resignation wasn't filed at Companies House until 23rd December 2015. Hawes was replaced by David Hinsworth (DOB: 1.1973) appointed on 4th January 2015, although the paperwork wasn't received by Companies House until 6th December 2015. Hawes transferred the £100k worth of shares to Hinsworth on 5th January 2015.

Accounts to 31st December 2015

In the company's (Penketh Developments Ltd) first full year of trading to 31st December 2015 Hinsworth has continued Hawes' remarkable success. Total net assets are given as £2,073,962 against £1,161,234 to 31st December 2014.